Top Picks Report – January 2022

New Year Special

Please refer to important disclosures at the end of this report

1

January 2022

2

Top Picks Report – January 2022

New Year Special

The Indian economy had staged a V-shaped recovery post the second Covid wave

in Q1FY2022 due to the quick reopening of the economy. Moreover strong festive

demand also helped the recovery process. The manufacturing PMI for November

hit a 10-month high of 56.3 while services PMI at 58.1 for November point to a

continued solid pace of expansion in the services sector. While we expect the

economic recovery to continue, high global inflation and aggressive tightening by

the US Fed will be key issues in CY2022, though the impact of Omicron variant

should be transient and limited to 1QCY2022. We are positive on banking and

Consumer-facing sectors as we do not see any long lasting impact from Omicron

and expect strong rebound in earnings for the sectors in FY2023. We also remain

positive on Chemicals and IT sector given high medium-term growth visibility for

both the sectors.

High-frequency indicators point to continued economic recovery

High-frequency indicators like PMI numbers, GST collection, and E-way bill

generation, etc. continue to point to a quicker than expected recovery in the

economy. Strong festive demand also contributed to the recovery process. The

manufacturing PMI for November hit a 10-month high of 56.3 and points to a

continued strong rebound in the manufacturing sector. Services PMI at 58.1 for

November also point to a continued solid pace of expansion post reading of 58.4 in

October. GST collection for Nov’21 was up by 25% Yoy to ₹1.31 lakh Cr. and

corroborates the economic recovery.

Accelerated tapering and Omicron strain contributing to uncertainties

Markets turned volatile from the second half of November due to the emergence of

Omicron strain of Coronavirus in South Africa (RSA) and accelerated tapering

timelines by the US Fed. In the Dec’21 FOMC meeting, the US Fed has accelerated

the timeline for tapering to Mar’22 from Jun’22 while the dot plots indicate at least

three rate hikes by the end of 2022. Accelerated tapering by the US Fed and the

rapid spread of Omicron globally has led to selloff by FII’s thus leading to increased

volatility in the markets.

High vaccination coverage should limit fallout from any potential third wave

India’s vaccination coverage has increased significantly over the past few months

with over 60%/41% of the total population being partially/fully vaccinated.

Moreover, anecdotal evidence suggests that though the Omicron strain is highly

contagious it doesn’t cause serious illness like the Delta variant. Increased

vaccination coverage and low severity should help in limiting the fallout from any

potential third wave due to the new Omicron strain.

Banking, Consumer-facing sectors to do well along with Chemicals & IT

Given the aggressive tightening by the US Fed, there will be a slowdown in FII flows

next year though domestic flows should remain robust and make up for any

shortfall in FII flow. From a sector perspective, we are positive on Banking, and

consumer-facing sectors given expectations of strong earnings growth in

FY2023E. We also remain positive on Chemicals and IT sector given high medium-

term growth visibility for both the sectors.

Top Picks

Company

CMP (`)

TP (`)

Auto

Ashok Leyland

123

175

Sona BLW Precis.

706

959

Ramkrishna Forg.

935

1545

Suprajit Engg.

420

520

Banking

Federal Bank

81

135

HDFC Bank

1450

1859

AU Small Finance

1006

1520

Chemical

P I Industries

2892

3440

IT

HCL Technologies

1267

1363

Others

Carborundum Uni.

921

1100

Stove Kraft

957

1288

Safari Inds.

869

1126

Sobha

864

1050

Amber Enterp.

3332

4150

Source: Company, Angel Research

CMP as on 27th Dec’21

January 2022

3

Top Picks Report – January 2022

New Year Special

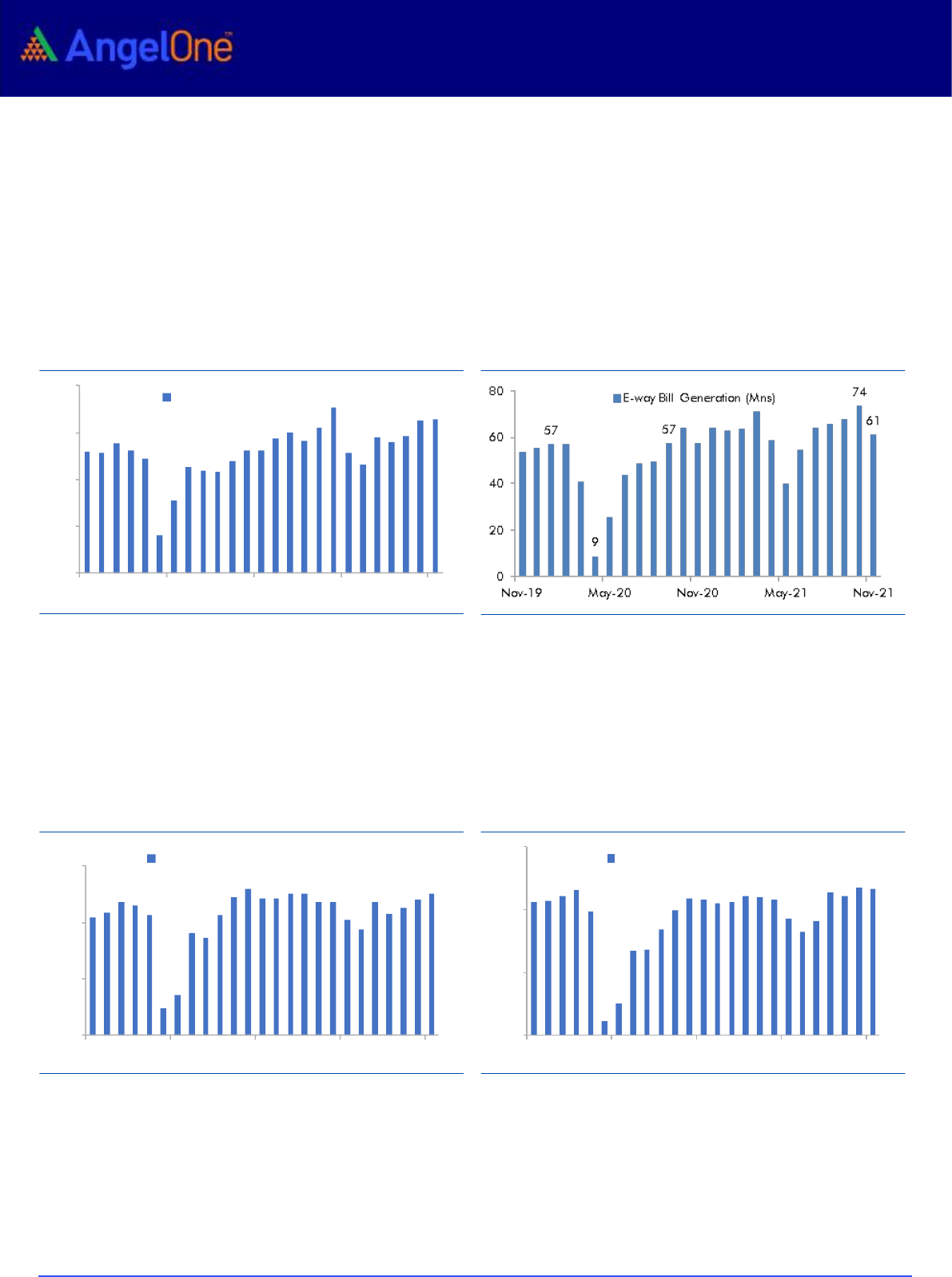

Indian Economy has bounced back strongly post the second wave

Indian economy witnessed good momentum in Q2-Q3 FY22 in anticipation of

demand recovery as the festive season approached. For the second straight month

in Dec’21, gross GST collection crossed ₹1.30 lakh crore and was at second highest

levels ever, second only to April 2021 which gets influenced due to year-end and

requirement for quarterly filings. E-way Bills generated too showed strong trends

before cooling off in November post the peak of the festive season. The data for

December till-date is encouraging, with numbers improving on a weekly average

basis against November 2021 indicating a pickup in economic activity.

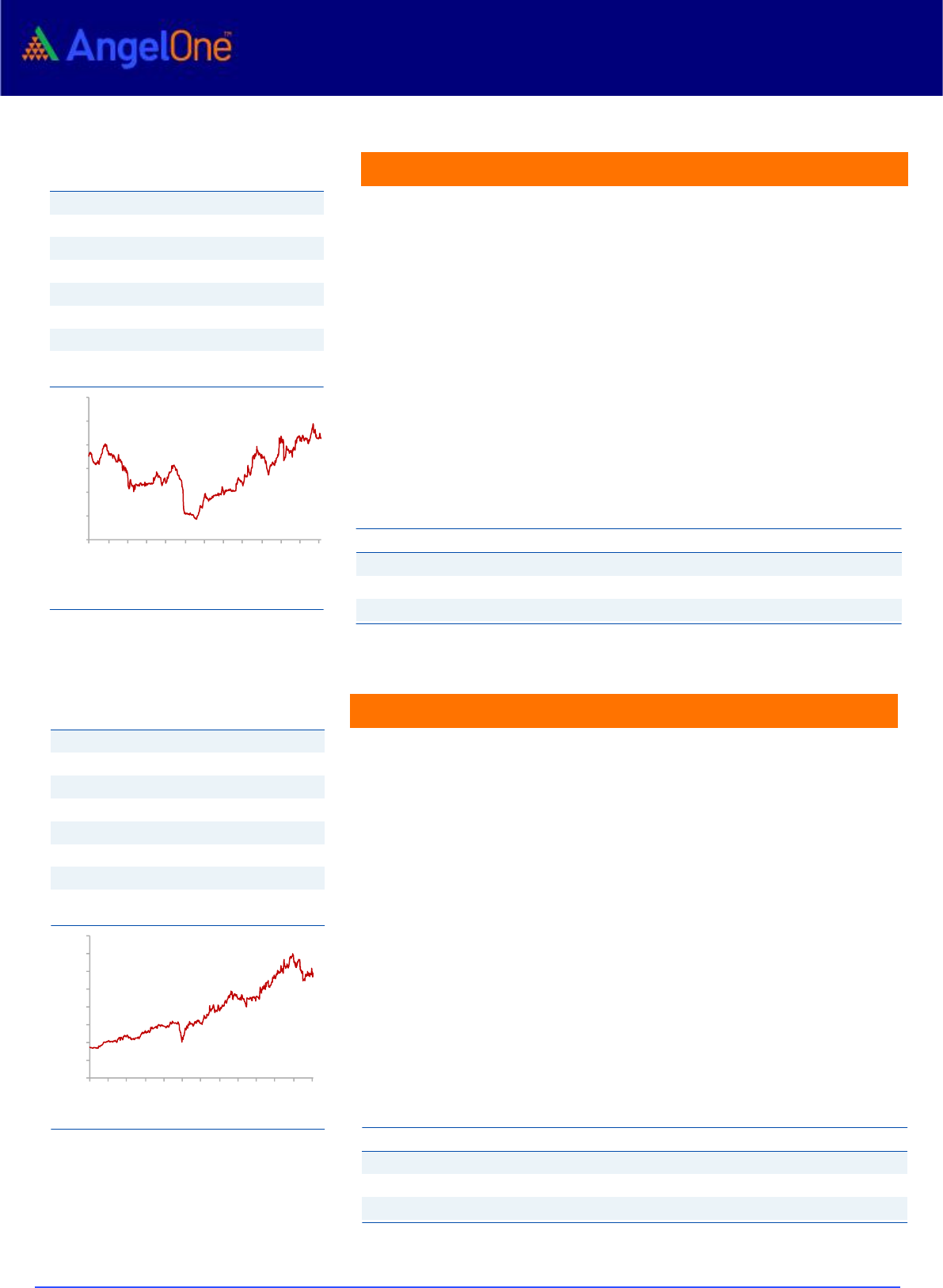

Exhibit 1: GST Collections are trending higher

Source: Angel Research, Bloomberg, GoI

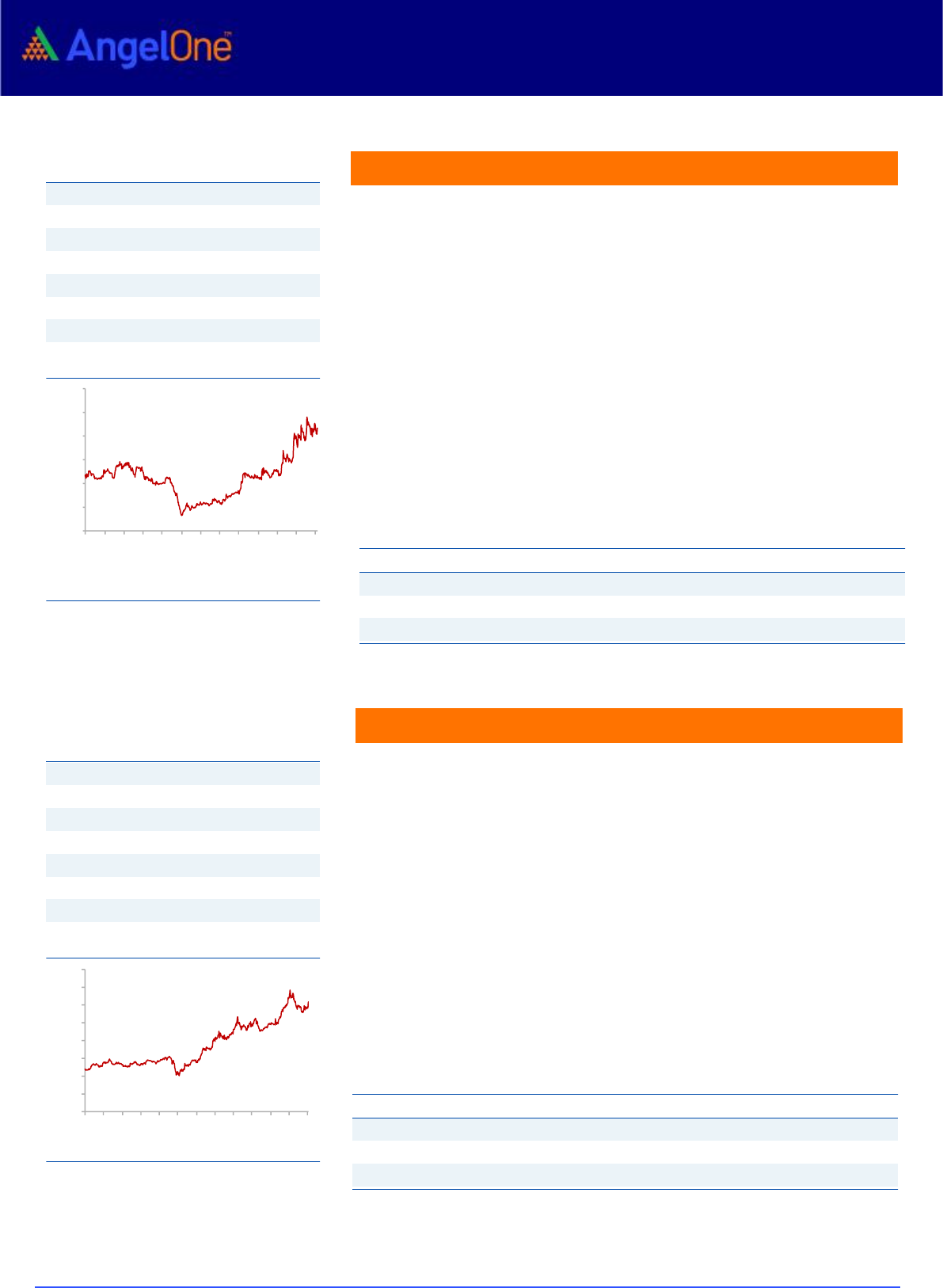

Exhibit 2: E-way Bill Generation also indicates pick-up

Source: Company, Angel Research, Bloomberg, GoI

As for the data from the IHS Markit survey, the manufacturing PMI hit a 10-month

high of 57.6 in Nov’21, pointing to a continued expansion in manufacturing

activities. Inflationary pressures are a cause of concern as they may impact

demand but factors like shipping rates and input prices like Crude, Coal, Iron Ore,

etc. have started to cool off post hitting their peaks during Sep-Oct 2021.

Exhibit 3: Manufacturing led initial recovery

Source: Angel Research, Bloomberg, IHS Markit

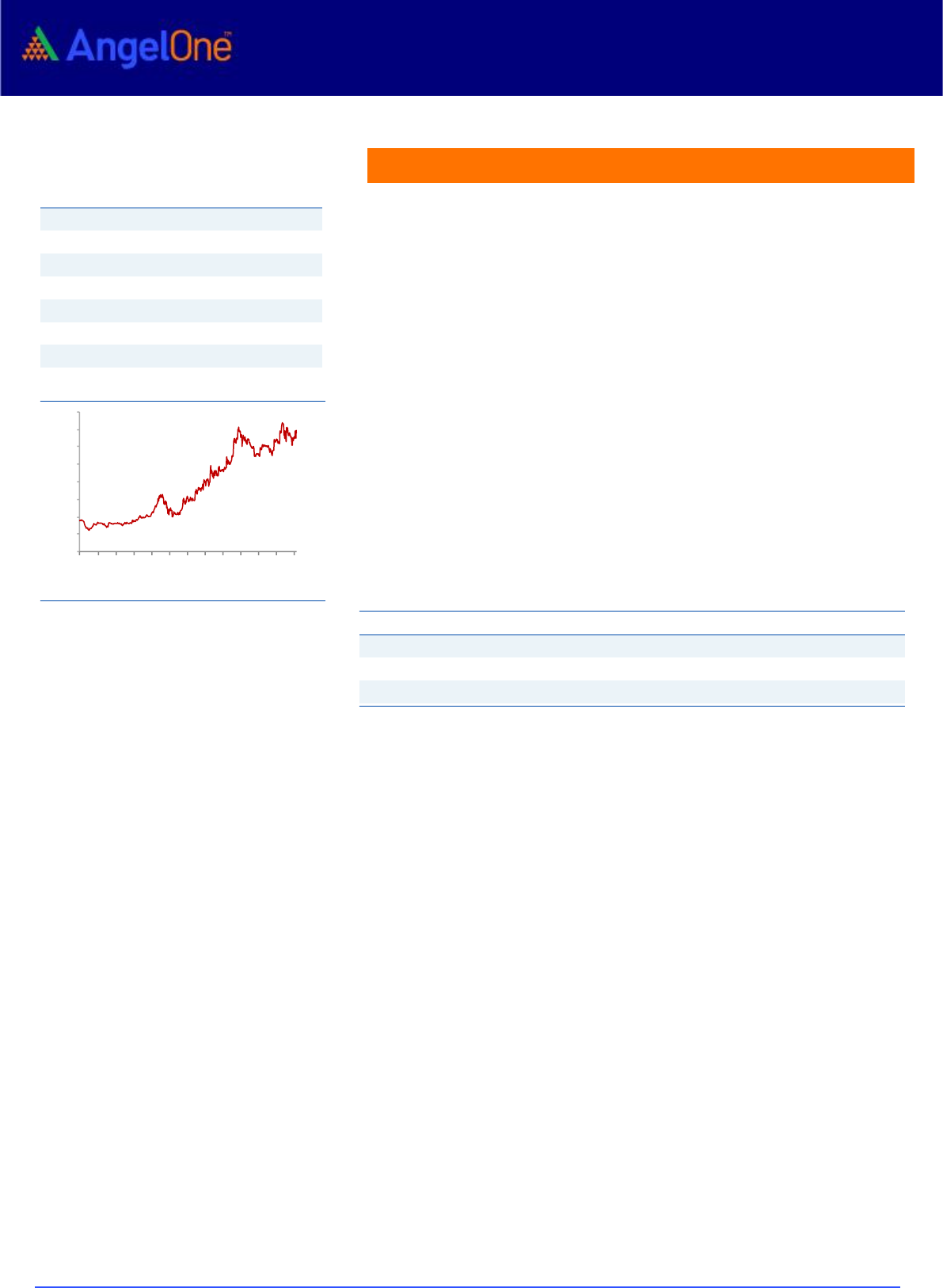

Exhibit 4: Services bounced back strongly in Q3FY22

Source: Angel Research, Bloomberg, IHS Markit

Services PMI which is expanding since Aug’21 came in at 58.1 for Nov’21 (58.4 for

Oct’21) which was the second fastest rise in business activity in nearly a decade.

The outlook remains optimistic but continued inflationary pressures may weigh

down on business confidence going ahead.

105

132

0

40

80

120

160

Nov/19

May/20

Nov/20

May/21

Nov/21

GST Collections (` Cr '000s)

55.3

56.3

48.1

57.6

20

35

50

65

Nov/19

May/20

Nov/20

May/21

Nov/21

IHS Markit India Manufacturing PMI

57.5

53.7

41.2

58.1

0

25

50

75

Nov/19

May/20

Nov/20

May/21

Nov/21

IHS Markit India Services PMI

Manufacturing has remained strong

and should carry the momentum in

CY2022

GST collection in Nov ’21 was as at

second highest levels ever since

introduction of GST

Services have rebounded strongly but

inflationary pressures may impacts

entiment

January 2022

4

Top Picks Report – January 2022

New Year Special

Tapering and Omicron have led to increased volatility in markets

The US Fed in its latest FOMC meeting has accelerated the timeline for tapering to

Mar’22 from Jun’22 and now expects at least three rate hikes by the end of 2022 as

compared to expectations of one rate hike in the Oct’21 meeting. The accelerated

tapering timeline by the US Fed combined with the rapid spread of the Omicron

strain in South Africa (RSA) towards the end of Nov’21 led to a sharp selloff in the

markets.

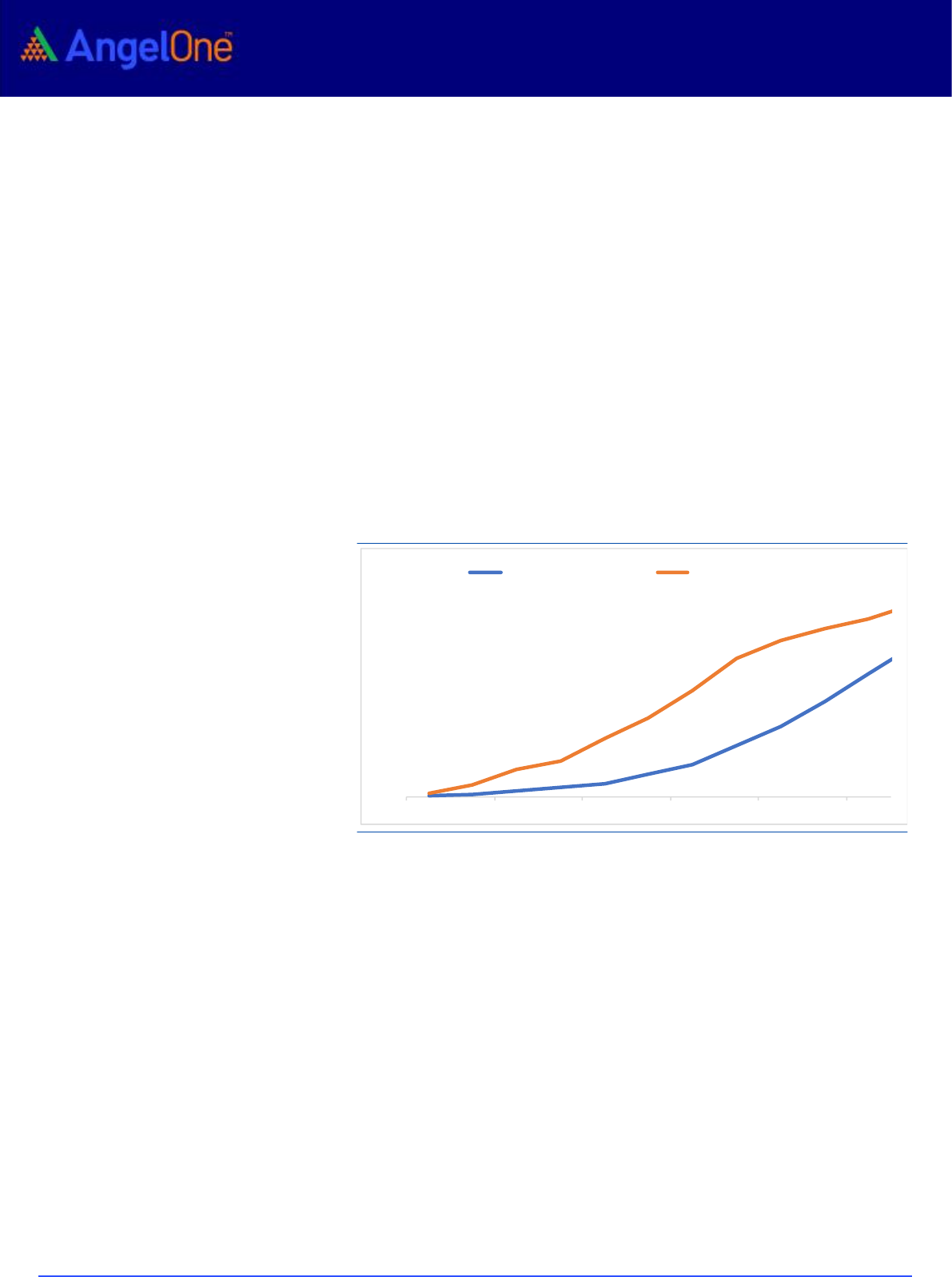

The Omicron strain has spread rapidly from South Africa to the rest of the world

with countries like the UK and the USA reporting a surge in new cases in the past

few weeks. While it is expected that the Omicron variant will spread in India, our

vaccination coverage has increased significantly over the past few months with

over 60%/41% of the total population being partially/fully vaccinated. Moreover,

anecdotal evidence suggests that though the Omicron strain is highly contagious it

does not cause serious illness like the Delta variant. Therefore we expect the

impact of Omicron variant should be transient and limited to 1QCY2022 given

increased vaccination coverage and low severity.

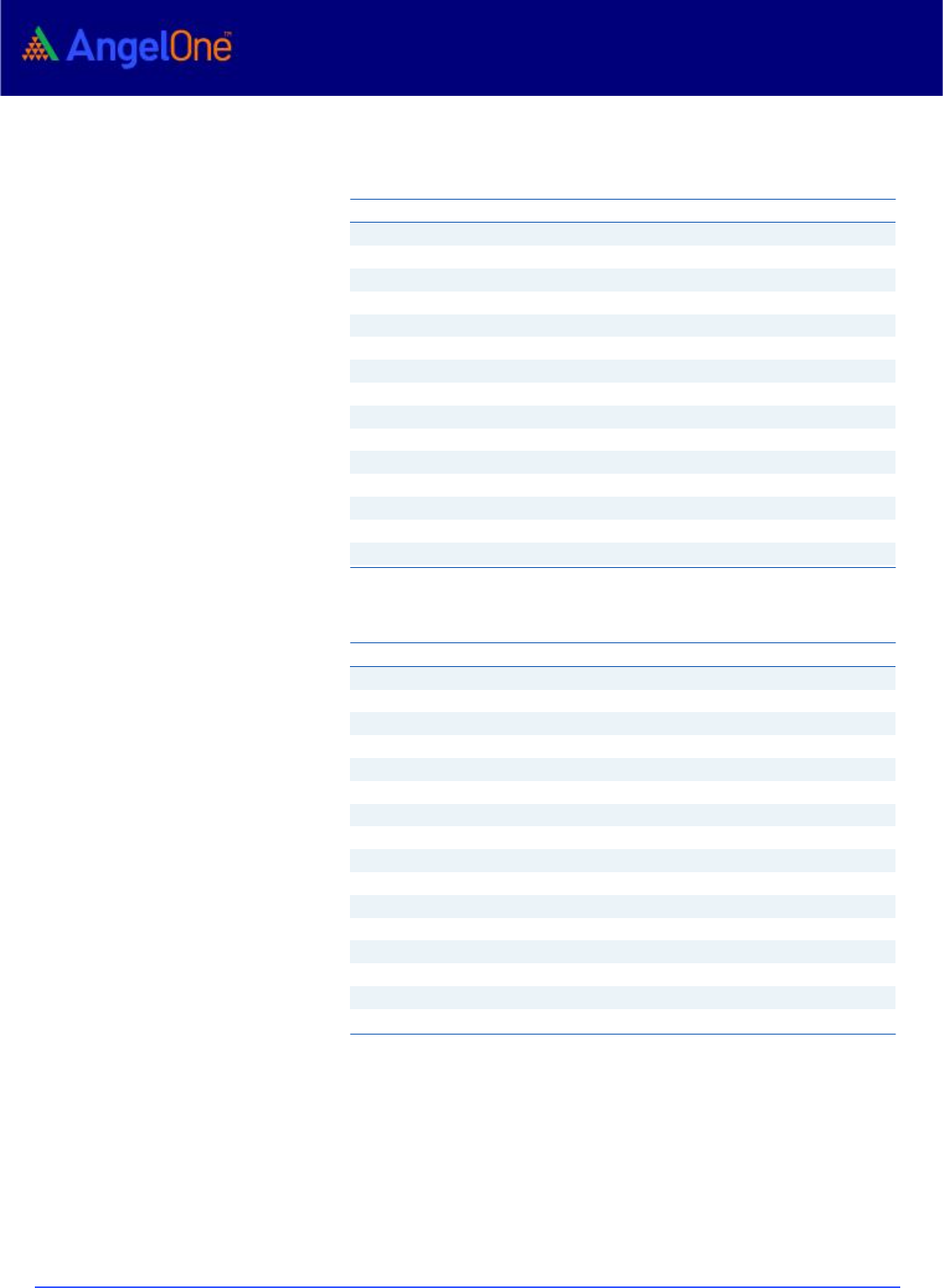

Exhibit 5: High vaccination rates should help going forward

Source: Government of India, Angel Research,

Market view and outlook

Given the aggressive tightening by the US Fed, there will be a slowdown in FII flows

next year though domestic flows should remain robust and make up for any

shortfall in FII flow. Nifty P/E based on consensus rolling one year forward

multiples have come down from ~23.0x to 20.7x, though it’s still at a 10% premium

to 5 year historical average of 18.6x. Given premium valuations and likely slowdown

in FII flows, we believe that we are unlikely to witness a broad-based rally like last

year, and hence bottom-up stock picking will be the key to generating alpha going

forward.

From a sector perspective, we are positive on Banking, and Consumer-facing

sectors given expectations of strong earnings growth in FY2023. We Also remain

positive on Chemicals and IT sector given high medium-term growth visibility for

both sectors. We are also positive on Building Materials and Real Estate Sectors

given low interest rates and the Government’s focus on housing & construction.

41.8%

60.7%

0%

20%

40%

60%

80%

Feb-21

Apr-21

Jun-21

Aug-21

Oct-21

Dec-21

Fully Vaccinated %

Part. Vaccinated %

We are positive on banking, building

material, chemicals, consumption, IT,

and real estate sector

US Fed has accelerated timelines for

tapering due to sustained high

inflation levels

Increased vaccination coverage

should provide fallout from possible

third wave

Angel Top Picks – Aug 2021

Please refer to important disclosures at the end of this report

5

New Year Picks

January 2022

6

Top Picks Report – January 2022

New Year Special

Federal Bank is one of India's largest old generation private sector banks. At

the end of H2FY2022 the bank had total assets of ₹2.06 lakh cr. with

deposits of ₹1.72 lakh cr. and a loan book of ₹1.34 lakh cr.

Federal Bank has posted a good set of numbers for Q2FY2022 as NII/

advances increased by 7.2%/9.5% YoY. Provisioning for the quarter was

down by 58.6% YoY because of which PAT was up by 49.6% YoY. GNPA and

NNPA ratio improved to 3.25% and 1.12% while restructuring went up by

~75bps qoq to 2.6% of advances.

Overall asset quality for the quarter improved in Q2FY2022, which was

better than our expectations. We expect asset quality to improve further in

H2FY2022 given continued opening up of the economy. We expect the

Federal bank to post NII/PPOP/PAT CAGR of 22.8%/23.7%/23.2% between

FY2020-23 and remain positive on the bank.

HDFC Bank

HDFC Bank is India's largest private sector bank with a loan book of ₹12 lakh

crore in H2FY2022 and deposit base of ₹14 lakh crore. The bank has a very

well spread-out book with wholesale constituting ~54% of the asset book

while retail accounted for the remaining 46% of the loan book.

Q2FY2022 numbers were better than expected as GNPA/ NNPA reduced by

12/8bps QoQ to 1.35% and 0.40% of advances. Restructured advances at the

end of the quarter stood at 1.5% of advances. The bank posted

NII/PPOP/PAT growth of 12.5%/14.4%/17.6% for the quarter on the back of

strong loan growth of 15.5% YoY. NIMs for the quarter were stable

sequentially at 4.1%.

The management has indicated that there will be maximum impact of 10-

20bps on asset quality from the restructured pool. Given the best in class

asset quality and expected rebound in growth from H2 FY2022 we are

positive on the bank given reasonable valuations at 2.9xFY23 adjusted book

which is at a discount to historical averages.

Stock Info

CMP

81

TP

135

Upside

66%

Sector

Banking

Market Cap (` cr)

17,079

Beta

1.4

52 Week High / Low

108/61

3-Year-Chart

-

20

40

60

80

100

120

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stock Info

CMP

1,450

TP

1,859

Upside

28%

Sector

Banking

Market Cap (` cr)

8,03,731

Beta

1.1

52 Week High / Low

1724/1342

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Federal Bank

Key Finances

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(`cr)

(%)

(`cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2022E

6,472

3.0

2,094.6

10.0

83.9

1.0

11.9

8.2

1.0

FY2023E

8,562

3.4

3,409.8

16.2

99.1

1.4

16.5

5.1

0.8

Source: Company, Angel Research

HDFC Bank

Key Finances

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(`cr)

(%)

(`cr)

(`)

(%)

(%)

(%)

(x)

(x)

FY2022E

74521

4.0

37667

68.0

416

2.0

17.5

21.2

3.5

FY2023E

88221

4.1

45076

81.4

496

2.1

17.7

17.7

2.9

Source: Company, Angel Research

January 2022

7

Top Picks Report – January 2022

New Year Special

AU Small Finance Bank (AU SFB) is one of the leading Small Finance Banks with

AUM of ~₹34,688 Cr. at the end of Q1FY2022. It has a well-diversified

geographical presence across India. Wheels (auto) and SBL-MSME segments

account for 37% and 39% of the AUM respectively.

Q2FY2022 numbers were better than expected as GNPA/ NNPA reduced by

123/61bps QoQ to 3.16% and 1.65% of advances. Restructured advances at the

end of the quarter stood at 3.6% of advances. The bank posted NII growth of

34% for the quarter on the back of strong AUM growth of 24% YoY while NIMs

for the quarter stood at 6.0%

We expect AU SFB to post a robust NII/PPOP/ PAT CAGR of

21.7%/25.1%/26.4% between FY2020-23 on the back of AUM CAGR of 23.6%.

Reducing cost of funds will also help NIM expansion going forward. We believe

that the worst is over for the bank in terms of asset quality and expect

significant improvement in asset quality in H2FY2022 which should lead to a

rerating.

Key Finances

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(`cr)

(%)

(`cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2022E

3052

5.4

1344

32.0

209.8

1.8

14.8

32.6

4.8

FY2023E

3899

5.6

1582

44.0

253.8

2.0

17.2

23.8

4.0

Source: Company, Angel Research

AU Small Finance

Stock Info

CMP

1,006

TP

1,520

Upside

51%

Sector

Banking

Market Cap (` cr)

31,573

Beta

1.5

52 Week High / Low

1389/841

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

January 2022

8

Top Picks Report – January 2022

New Year Special

The Ashok Leyland Ltd (ALL) is one of the leading players in the Indian CV

industry with a ~28% market share in the MHCV segment in FY21. The

company also has a presence in the fast-growing LCV segment where it is

witnessing marker share gains.

CV segment has held up well in the current year despite challenges.

Improvement in business sentiments along with spending on infrastructure

are likely to drive demand in the medium term. The bus segment is also

likely to bounce back going ahead with improvement in activities for the

end-users.

FY21 MHCV industry production volumes have been at the lowest levels seen

in ~12 years and we believe that the company is ideally placed to capture the

growth revival in the CV segment. We believe that ALL will be the biggest

beneficiary of the Government's voluntary scrappage policy and hence rate

the stock a BUY.

Sona BLW is one of India's leading automotive technology companies that

derives ~40% of its revenues from Battery Electric Vehicles (BEV) and

Hybrid Vehicles. It supplies EV differential assemblies and gears, BSG

systems, and EV traction motors to global customers. ~75% of their income

from the sale of goods in FY21 came from end-use in the overseas markets.

This global BEV segment has been fastest growing and is expected to

maintain high growth rates, which are positive for Sona BLW.

Sona BLW has a strong market share ranging from 55-90% for differential

gears for PV, CV, and tractor OEMs in India. The company's combined motor

and driveline capabilities have enabled them to gain market share across its

products especially for products related to EV/BEV.

Given the traction in the BEV/Hybrid Vehicle space, we believe that Sona

BLW will continue to command a higher multiple, which is justified by ~49%

earnings CAGR over FY21-24E.

Ashok Leyland

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

21,316

7.0

353

1.2

4.8

104.8

4.8

1.8

FY2023E

30,241

10.5

1642

5.6

20.9

22.5

4.2

1.3

Source: Company, Angel Research

Sona BLW Precis.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

2,171

26.9

335

5.7

23.0

122.5

29.2

21.8

FY2023E

2,997

28.3

500

8.6

28.3

81.2

24.6

15.8

Source: Company, Angel Research

Stock Info

CMP

123

TP

175

Upside

42%

Sector

Auto

Market Cap (` cr)

36,063

Beta

1.5

52 Week High / Low

153/92

3-Year-Chart

-

20

40

60

80

100

120

140

160

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stock Info

CMP

706

TP

959

Upside

36%

Sector

Auto

Market Cap (` cr)

41,247

Beta

1.2

52 Week High / Low

839/295

7-Months-Chart

-

100

200

300

400

500

600

700

800

900

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Source: Company, Angel Research

January 2022

9

Top Picks Report – January 2022

New Year Special

Ramkrishna Forgings (RKFL), a leading forging player in India and among a

select few having heavy press, stands to benefit from a favorable demand

outlook for the Medium & Heavy Commercial Vehicle (M&HCV) industry in

domestic and other key geographies in the near term.

The company has phased out its CAPEX over the past few years during

which it was impacted by industry slowdown in certain periods. With the

end to the CAPEX cycle, the favorable outlook in the medium term, and with

sufficient capacity in place, we believe RKFL volumes would be able to post

volume CAGR of 29% over FY21-23E.

RKFL has been able to add new products, which have higher value addition.

Better mix along with operating leverage is expected to result in ~550 YoY

bps EBITDA margin improvement in FY22E.

Suprajit Engineering (SEL), is the largest supplier of automotive cables to

the domestic OEMs with a presence across both 2Ws and PVs. Over the

years, SEL has evolved from a single product/client company in India to have

a diversified exposure which coupled with its proposition of low-cost player

has enabled it to gain market share and more business from existing

customers.

SEL has outperformed the Indian Auto industry in recent years (posting

positive growth vs low double-digit declines for the domestic 2W and PV

industry in FY21). The company believes that consolidation of vendors and

new client additions would help in maintaining the trend of market/wallet

share gains.

SEL has grown profitably over the years and as a result, it boasts a strong

balance sheet (net cash). We believe SEL is a prime beneficiary of a ramp-up

in production by OEMs across the globe and is well insulated from the threat

of EV (is developing new products). Its premium valuations are justified in

our opinion owing to its strong outlook and top-grade quality of earnings.

Ramkrishna Forg.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

2,213

23.5

216.0

63.4

19.5

15.0

3.5

2.0

FY2023E

2,595

23.9

293.0

83.0

21.5

11.5

2.8

1.6

Source: Company, Angel Research

Suprajit Engg.

Stock Info

CMP

935

TP

1,545

Upside

65%

Sector

Auto

Market Cap (` cr)

2,993

Beta

1.0

52 Week High / Low

1260/451

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stock Info

CMP

420

TP

520

Upside

24%

Sector

Auto

Market Cap (` cr)

5,813

Beta

1.1

52 Week High / Low

475/190

3-Year-Chart

-

50

100

150

200

250

300

350

400

450

500

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

1,969

14.8

168

12.2

16.2

33.5

5.3

3.2

FY2023E

2,916

15.3

268

19.3

22.9

21.2

4.6

2.1

Source: Company, Angel Research

January 2022

10

Top Picks Report – January 2022

New Year Special

Carborundum Universal (CUMI) is a leading manufacturer of abrasives,

industrial ceramics, refractories, and electro minerals (EMD) in India having

application across diversified user industries. CUMI is expected to benefit

from improving demand scenarios across its end-user industries such as

auto, auto components, engineering, basic metals, infrastructure, and

power.

CUMI has shown good execution in recent quarters with a strong

performance in Abrasives and EMD segments. Within Abrasive, the company

is gaining market share (supply chain issues/preference for Indian suppliers)

and should benefit from a good end-user industry demand. EMD

performance is likely to sustain owing to strong pricing and volumes (due to

the China+1 strategy of its customers).

Overseas operations have also improved and operations are expected to be

at normal levels. We believe that CUMI’s leadership position in the domestic

abrasives market, well-diversified presence, launches of value-added

products, and healthy cost advantages would sustain the improvement in

profitability and enhance cash generation.

Stove Kraft Ltd (SKL) is engaged in the business of manufacturing and

selling Kitchen and Home appliances products like pressure cookers, LPG

stoves, non-stick cookware, etc. under the brand names 'Pigeon' and 'Gilma'.

In the Pressure Cookers and Cookware segment, over the last two years, the

company has outperformed the industry and its peers. Post-Covid,

organized players are gaining market share from unorganized players which

would benefit the player like SKL.

Going forward, we expect SKL to report healthy top-line & bottom-line

growth on the back of new product launches, a strong brand name, and wide

distribution network.

Carborundum Universe

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

3,247

19.5

432

22.8

18.6

40.5

6.8

5.0

FY2023E

3,851

19.2

516

27.2

19.0

33.9

5.8

4.1

Source: Company, Angel Research

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

1160.2

10.8

75.3

23.1

20.0

41.3

8.3

4.7

FY2023E

1369.0

11.7

105.3

32.3

21.8

29.5

6.5

3.5

Source: Company, Angel Research

Stock Info

CMP

921

TP

1,100

Upside

19%

Sector

Others

Market Cap (` cr)

17,485

Beta

0.7

52 Week High / Low

1008/368

3-Year-Chart

-

200

400

600

800

1,000

1,200

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stove Kraft

Stock Info

CMP

957

TP

1,288

Upside

35%

Sector

Others

Market Cap (` cr)

3,134

Beta

1.0

52 Week High / Low

1135/400

11-Months-Chart

-

200

400

600

800

1,000

1,200

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Source: Company, Angel Research

January 2022

11

Top Picks Report – January 2022

New Year Special

Safari Industries (India) Ltd (SIIL) is amongst the leading luggage players

with a market share of ~18% market share in the organized sector. Being a

market leader in the mass segment as well as a shift from unorganized to

organized sectors would benefit SIIL.

Over the last three years, the company has outperformed luggage Industries

in terms of sales growth. The company has a wide distribution network

which would support growth going ahead. Focused product strategy and

diversified product portfolio are likely to boost growth.

Going forward, we expect SIIL to report strong top-line and bottom-line

growth on the back of strong growth in the organized sector, wide

distribution network, strong brand and promoter initiatives.

PI Industries is a leading player in providing Custom Synthesis and

Manufacturing Solutions (CSM) to global Agrochemical players. The CSM

business accounted for over 70% of the company's revenues in FY21 and is

expected to be the key growth driver for the company in the future.

The company has been increasing its share of high-margin CSM business

driven by strong relationship with global agrochemical players. PI is

leveraging its chemistry skill sets and is looking to diversify its CSM portfolio

to Electronic Chemicals, Pharma API, Fluoro Chemicals, etc. which will help

drive business.

We expect PI Industries to post Revenue/PAT CAGR of 20.0%/22.5%

between FY21-FY24 driven by 20% growth in the CSM business over the next

2-3 years. Moreover, foray into new segments like Electronic Chemicals and

APIs will also help drive growth over the next 3-4 years for the company.

Safari Inds.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

652.0

8.5

27.0

11.9

13.2

71.4

9.5

3.1

FY2023E

1024.0

10.3

63.0

28.3

24.4

30.0

7.4

2.0

Source: Company, Angel Research

P I Industries

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

5602.9

23.0

932.4

61.3

15.1

47.9

3.6

7.4

FY2023E

6695.9

23.3

1133.7

74.6

15.8

39.4

3.1

6.1

Source: Company, Angel Research

Stock Info

CMP

869

TP

1,126

Upside

30%

Sector

Others

Market Cap (` cr)

1,946

Beta

0.6

52 Week High / Low

985/503

3-Year-Chart

-

200

400

600

800

1,000

1,200

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stock Info

CMP

2,892

TP

3,440

Upside

19%

Sector

Chemical

Market Cap (` cr)

43,873

Beta

0.8

52 Week High / Low

3533/1982

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

January 2022

12

Top Picks Report – January 2022

New Year Special

The company operates in Residential and Commercial real-estate along with

Contractual business. 70% of residential pre-sales for Sobha comes from

the Bangalore market which is the main IT hub in India and we expect new

hiring by the IT industry will increase residential demand in the South India

market.

Ready to move inventory and under construction inventory levels have

moved down to their lowest levels. Customers are now having a preference

towards branded players like Sobha Developers.

The company expects to launch 17 new projects/phases spread over

12.56mn sqft across various geographies. The majority of launches will be

coming from the existing land bank of approximately. 200mn Sqft of salable

area.

HCL Tech (HCLT) is amongst the top four IT services companies based out of

India and provides a vast gamut of services like ADM, Enterprise Solutions,

Infrastructure Management Services etc.

IT Services witnessed robust growth of 5.2% QoQ CC in Q2FY22. New deal

TCV at USD 2.3bn was up by 38% YoY and included 4 large deals. Strong deal

wins will help drive growth in the services business which should make up

for any shortfall in the product business due to the delays in deal signing.

At CMP the stock is trading at a significant discount to the other large-cap IT

companies like Infosys and TCS and offers tremendous value at current

levels given market leader status in Infrastructure Management Services.

Sobha

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

2706.2

0.6

201.0

21.2

7.8%

40.4

3.1

2.8

FY2023E

3597.5

0.6

749.0

79.0

23.1%

10.9

2.5

2.1

Source: Company, Angel Research

HCL Technologies

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

84,844

19.3

13,234

48.1

19.0

25.5

10.0

3.8

FY2023E

97,991

19.4

15,007

54.5

19.0

22.5

8.8

3.2

Source: Company, Angel Research

Stock Info

CMP

864

TP

1,050

Upside

22%

Sector

Others

Market Cap (` cr)

8,194

Beta

1.3

52 Week High / Low

977/320

3-Year-Chart

-

200

400

600

800

1,000

1,200

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

Stock Info

CMP

1,267

TP

1,363

Upside

8%

Sector

IT

Market Cap (` cr)

3,43,740

Beta

0.8

52 Week High / Low

1377/890

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

January 2022

13

Top Picks Report – January 2022

New Year Special

Amber Enterprises India Ltd. (Amber) is the market leader in the Room Air

Conditioners (RAC) outsourced manufacturing space in India. Amber would

outperform the industry due to its dominant position as a Room AC contract

manufacturer, increase in the share of business in existing customers as

well as new client additions.

Amber plans to increase revenues from components (by increasing product

offerings, catering to newer geographies, adding new clients) and exports

(already started in the Middle east). In the past 2-3 years, Amber has

acquired companies like IL JIN Electronics, Ever and Sidwal Refrigeration

Industries, which would help in backward integration and also help the

company to foray into different segments like railway, metro, and defense.

Going forward, we expect the company to witness healthy profitability on

the back of foray into the Commercial AC segment, entry into export

markets, and participation in the PLI scheme.

Amber Enterp.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(`cr)

(%)

(`cr)

(`)

(%)

(x)

(x)

(x)

FY2022E

4004.0

7.1

150.4

45.4

8.6

74.7

6.3

2.7

FY2023E

5620.0

8.6

262.7

78.9

13.1

43.0

5.5

2.0

Source: Company, Angel Research

Stock Info

CMP

3,332

TP

4,150

Upside

25%

Sector

Others

Market Cap (` cr)

11,225

Beta

0.5

52 Week High / Low

3788/2287

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Jan-19

Apr-19

Jun-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Source: Company, Angel Research

January 2022

14

Top Picks Report – January 2022

New Year Special

Stock sold in last 6 Month

Stock

Date

Reco

Price

Quess Corp

15-Jul-21

EXIT

751

Apollo Hospitals

27-Jul-21

EXIT

4,100

IDFC First Bank

5-Aug-21

EXIT

47

Galaxy Surfact.

18-Aug-21

EXIT

2,997

Jindal Steel

23-Aug-21

EXIT

362

Godrej Propert.

25-Aug-21

EXIT

1,437

Escorts

31-Aug-21

EXIT

1,348

Sobha

7-Sep-21

EXIT

780

Crompton Gr. Con

14-Sep-21

EXIT

484.00

Dalmia BharatLtd

22-Sep-21

EXIT

2,143

Bajaj Electrical

24-Sep-21

EXIT

1,499

L & T Infotech

27-Sep-21

EXIT

5,950

GNA Axles

19-Oct-21

EXIT

1,076

Whirlpool India

3-Nov-21

EXIT

2,074

Shri.City Union.

6-Dec-21

EXIT

2,066

Lemon Tree Hotel

17-Dec-21

EXIT

47.25

Source: Company, Angel Research

Stock bought in Last 6 Month

Stock

Date

Reco

Price

Galaxy Surfact.

7-Jul-21

BUY

3,135

AU Small Finance

9-Jul-21

BUY

1,148

Dalmia BharatLtd

15-Jul-21

BUY

2,218

Safari Inds.

19-Jul-21

BUY

742

HDFC Bank

5-Aug-21

BUY

1,490

Sona BLW Precis.

25-Aug-21

BUY

484

Bajaj Electrical

27-Aug-21

BUY

1,189

Sobha

31-Aug-21

BUY

627

P I Industries

9-Sep-21

BUY

3,420

Amber Enterp.

14-Sep-21

BUY

3243.00

Sobha

22-Sep-21

BUY

729.00

Lemon Tree Hotel

23-Sep-21

BUY

43.25

Whirlpool India

29-Sep-21

BUY

2,299

Ramkrishna Forg.

13-Oct-21

BUY

1,220

HCL Technologies

20-Dec-21

BUY

1,159

Source: Company, Angel Research

January 2022

15

Top Picks Report – January 2022

New Year Special

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel

or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty,

express or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a

reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from

doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the

subject company. Research analyst has not served as an officer, director or employee of the subject company.

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

January 2022

16

Top Picks Report – January 2022

New Year Special